Generally, pre-field exchange lessons offer a windows from chance for the individuals seeking to to remain told and agile in the immediate bitwave ethereum face of economic developments one are present away from normal exchange days. These classes focus on investors and you can investors looking to respond to reports, earnings account, and you may around the world situations, whilst making it possible for a far more versatile exchange agenda. After-times trade could have pros to have buyers looking to cash in on expected reports, otherwise this may offer a way of entering otherwise exiting the newest stock in the event the unanticipated news try established. The standard trade classes provide best liquidity and much more productive areas, that renders all cost more reflective out of fair really worth.

Immediate bitwave ethereum – Manage an account to unlock which Layout

I take a look at X, chatrooms, and you can Dissension observe where an inventory’s energy comes from. Pre-industry impetus are possibly fueled because of the hype otherwise news … whether it’s a cam place pump, I want to know what We’m getting into before We begin trade. Even with prolonged and immediately days, the market stays finalized ranging from Friday’s close from the 4 p.m. In order to qualify for introduction on this page, Barchart lists popular brings having a price more than $dos, and you may a levels more than step one,one hundred thousand. Prominent Professionals can be screen for the all pre-market equities through the Inventory Screener. There are several benefits and drawbacks out of doing premarket trade.

In the usa, the volume from holds exchanged everyday will probably be worth trillions from cash. TWP brings information one to its users are able to use to make its very own money conclusion. Although not, one customers might possibly be guilty of considering including advice cautiously and you can comparing the way it you are going to relate with one viewer’s own decision to find, offer or keep any financing. Change To your Professionals LLC (“TWP”) is actually a monetary degree vendor to own consumers seeking make the new feel and you may competence essential for shopping trading and investing from the economic areas. TWP isn’t a brokerage-Agent, a good investment Agent, or other sort of company at the mercy of control by the SEC, CFTC, county bonds government or one “self-regulatory business” (including FINRA).

⏰ Premarket Exchange Occasions by the Broker

Deals through the pre-business are mainly done as a result of ECNs and you can, in some instances, dark swimming pools. Such networks matches buy and sell requests electronically without the need for a great traditional stock market. Pre-market exchange is digital — no floor investors, simply ECNs matching requests. Reports falls can result in massive actions … but those movements is also reverse just as quick. Novices to find in the pre and you may pregnant they to keep powering when industry reveals.

Organization Information

Therefore, which compensation could possibly get effect just how, in which plus exactly what purchase issues appear inside listing categories, but where banned by law for the mortgage, home guarantee or other home financial loans. As we make an effort to provide a variety of now offers, Bankrate does not include information regarding all economic otherwise borrowing tool otherwise service. Use of reliable information is important to possess effective premarket exchange. Education from the business components and historic investigation research can raise trading actions. Because of the impression from fund and you will larger economic symptoms such as social protection trend can also render beneficial perspective to own premarket issues.

Make use of All of the Premarket Lesson

- An enthusiastic ECN try a service the representative spends to match purchase market sales and do deals.

- As opposed to fx and you can cryptocurrencies, brings usually are replaced inside the a small period in one day.

- The new NBBO specifications doesn’t affect prolonged-occasions trading therefore people will get receive a smaller price in one extended-occasions trading program compared to other.

- Nevertheless, you need to know the risks in it on account of lower frequency and therefore several brokers costs a lot more to possess premarket positions.

- Trading inside the expanded training (pre-business otherwise once-hours) can differ in the regular change lesson in lots of famous means.

- The stock exchange is considered the most involved in the set up world.

Prolonged trade classes, which include one another pre-field and you will immediately after-occasions exchange, render one another advantages and you will dangers to offer people that will be energetic throughout these symptoms. When the typical training comes to an end around 4pm, transfers continue delivering trading answers to their customers. Within several months, traders is also get to know stocks then pertain her or him. Although not, as in the new premarket lesson, the fresh trades are usually used playing with pending requests.

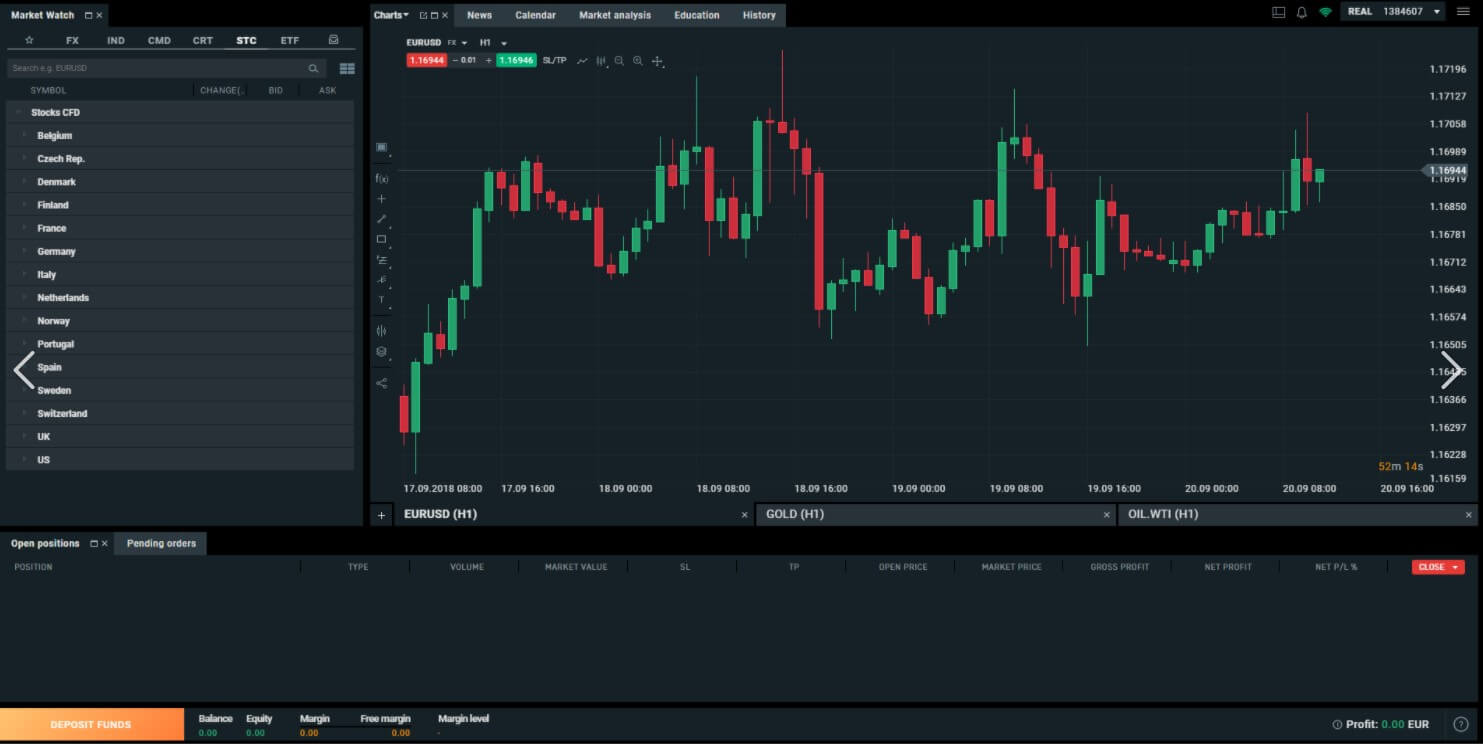

- To own top-notch-degrees stock and crypto maps, we advice TradingView – probably one of the most trusted networks certainly buyers.

- Stock Individual Network (STN) is your prominent place to go for greatest-level trading knowledge and information.

- Of numerous brokerages merely accept restriction requests inside the extended-occasions change to protect buyers of suddenly adverse cost.

- It’s got occur because of enhanced consult, particularly away from overseas traders that might efforts outside normal business instances.

- Many of the most extensively stored finest holdings in the benchmark indices also can score course in the eventuality of a significant pit up or off regarding the S&P 500 futures.

Become familiar with Right away Development and you can Situations

Change before the market reveals basically only lets limit requests. You could set a minumum of one limit orders according to the day’s development and you will industry hobby. It pushed people who had shorted the brand new inventory, or betted that price of those people brings perform fall, to find they so they you will avoid taking significant loss on their quick positions.

Symptoms for example swinging averages and Cousin Electricity Directory (RSI) can be focus on possible assistance or opposition profile. For instance, an appearing RSI might code overbought criteria, suggesting a potential speed reverse. The lower volume of premarket will offer an incorrect sign of the newest inventory’s really worth. Apply technical research to understand prospective change opportunities and you will manner in the pre-market change. This includes mode end-loss purchases to manage dangers efficiently.