Blogs

Which have rising prices in the read this article seventy percent and you may cost rising daily, the newest precious metal is a great hedge up against the challenges of the savings in the event you can also be myself be able to purchase it. While this activity are epic, there is certainly need to believe that much much more is found on the newest horizon—or perhaps heading unreported. Asia, before the largest international consumer out of silver, paused its orders in may 2024, that have silver nonetheless accounting for only 4.9percent of those’s Financial from China’s overall reserves. A lot more interesting is recent account indicating one Saudi Arabia features become privately to find gold in the Switzerland.

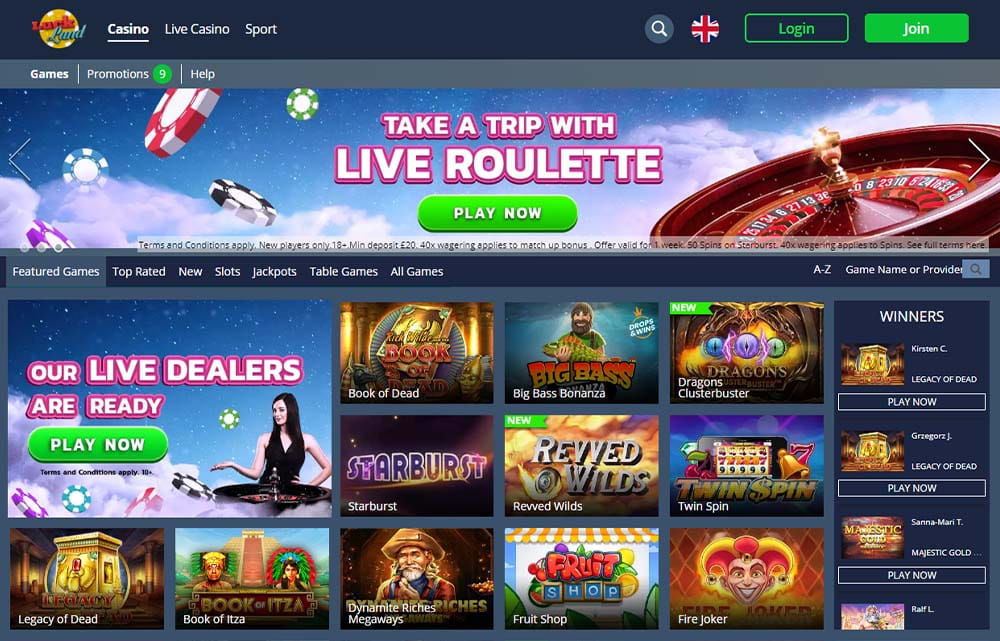

The greatest four step 1 put casinos

- Pros perceived over 40 silver veins, and therefore contains as much as 330 lots (300 metric lots) out of gold down to a level from six,600 ft (dos,one hundred thousand yards).

- Once again, the worldwide Metals MMI (Month-to-month Precious metals Index) don’t display solid bearish otherwise optimistic pressure.

- Osisko’s wholly had Metropolitan-Barry property surrounding the newest Windfall investment is actually smaller advanced, however, numerous silver situations were outlined in identical geological mode and you will rock many years as the Windfall.

- ING analysts create notice various other issues supporting silver, in addition to election suspicion from the You.S. and you can geopolitics.

The us government funds shortage is during the a staggering 2.dos trillion. And today, for the first time previously, interest repayments to your United states government debt has hit more than Us step 1 trillion annually. The new Treasury Agency and also the Government Set-aside Financial hold more than 8,133.46 tonnes in the way of gold pubs and coins, that have a current worth of from the 640 billion. Half this really is kept in the All of us silver depository understood while the Fort Knox, a good Us Armed forces installment within the Kentucky. Germany pursue having an excellent stockpile out of 3,351 tonnes, with Italy with dos,452 tonnes.

U.S. Bodies Carrying out an excellent “Proper Bitcoin Reserve”?

Underground innovation create begin in seasons six and you may ore birth two ages later. The newest PEA in depth a later on-tax web establish value at the a 5percent write off price out of C598 million and you may a later on-income tax internal rates from get back away from 32.8percent. Probe have intentions to mine deposits over the Courvan, Pascalis and you may Monique mineralized style from the Val d’Otherwise Eastern investment. For every have multiple dumps, most of which will be mined as the open pits playing with old-fashioned truck and spade procedures. Just last year a short financial assessment for Val d’Or Eastern outlined a mine life of twelve.five years generating typically 207,one hundred thousand ounce. The analysis projected very first capex away from C353 million and you can a later on-taxation repay period using a bottom matter of 1,500 for every ounce.

Despite previous inflows, international silver ETF moves inside the very first four months of 2023 stayed negative from the You654mn, equal to a great 13t decrease in holdings, mainly due to losings out of Eu finance (-USdos.6bn, -41t). However they are closely related to it and you may stocks try a extremely important individual sentiment barometer. When we pass its previous results and you can valuations, belief looks rather confident.

Initial silver production of Fekola underground is expected to help you start in the mid-2025. Silver’s twin reputation—a financial material and an industrial enter in—has proven useful. They advantages from a comparable macro tailwinds as the gold (safe-sanctuary request, weaker money prospects) while also riding the new revolution out of renewed commercial utilize (within the electronics, solar panels, and automotive portion). The brand new broad gold/gold ratio means after that possible connect-up from the gold, even if it proportion try infamously unstable. Silver’s relatively small industry and better beta will get expose high options and dangers to own effective people. The fresh gold-rush may come while the a shock to own American people, because of the “safer retreat” platinum’s checklist work with-right up does not correspond having prior events and therefore sparked all the-date highs to have gold, like the later 2000s economic crisis and the Covid-19 pandemic.

The newest constant Russia-Ukraine conflict, unresolved Middle east stress, and you may Us Government Reserve’s rate of interest cuts have the ability to lead to a great 29percent rally within the rates in the 2024. The brand new surge is largely inspired by the field volatility and tall sales because of the main banking companies, specifically Asia. “It’s our very own strategists’ common close-label enough time (the newest item they most anticipate to increase from the brief term), plus it’s along with the well-known hedge facing geopolitical and you can economic threats,” the new financing financial organization published from the piece. Gold cost in the past did actually change inside a range after peaking in the later 2023. It month, prices achieved the new highs, ultimately exceeding 2,150/ounce. In reality, gold continues to do new levels, operating rates to your an extension to the upside.

Below which modify, there’s however a lot of area for the most recent silver speed to go up (over 11 fold) earlier techniques the true 1980 BLS strategy rising prices-modified all of the-time-higher. The fresh strengthening gold pricing is along with a reflection of your own unsustainable and you can rapidly extracting financial items on the both You and you will Global profile and you can easily expanding money also have metrics, that point out went on fiat currency debasement. In the uk, the bank out of The united kingdomt, the very first time while the March 2020, slashed their standard interest rate away from 5.25percent to 5percent within the August, and also the Bank of The united kingdomt governor Andrew Bailey today states one Uk interest rate incisions is going to be a lot more aggressive. That it also function the uk is set to go on a rate cutting stage, all of these is silver positive. Such quite high scores are caused by this type of countries sometimes becoming gold exchange hubs, and/otherwise places which have conventional eager demand for silver, as well as probably an excellent geopolitical risk premium due to the disputes between East. Concurrently, because of the assumption away from highest silver rates and also the ensuing impetus, the fresh silver speed has viewed speculative trading hobby to the types exchanges inside the Asia (the fresh Shanghai Futures Change – SHFE) and on the newest COMEX.